Defined contribution plan calculator

The IRS contribution limit. Our Defined Benefit plan calculator gives a free estimate of your tax savings and overall plan accumulation.

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Compute your contributions today.

. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Learn About 2021 Contribution Limits Today. Ad Discover The Benefits Of A Traditional IRA.

You can register for a one-on-one session or. See how increasing your 457 Plan contributions can provide a valuable boost to your future savings. In a defined contribution plan the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by.

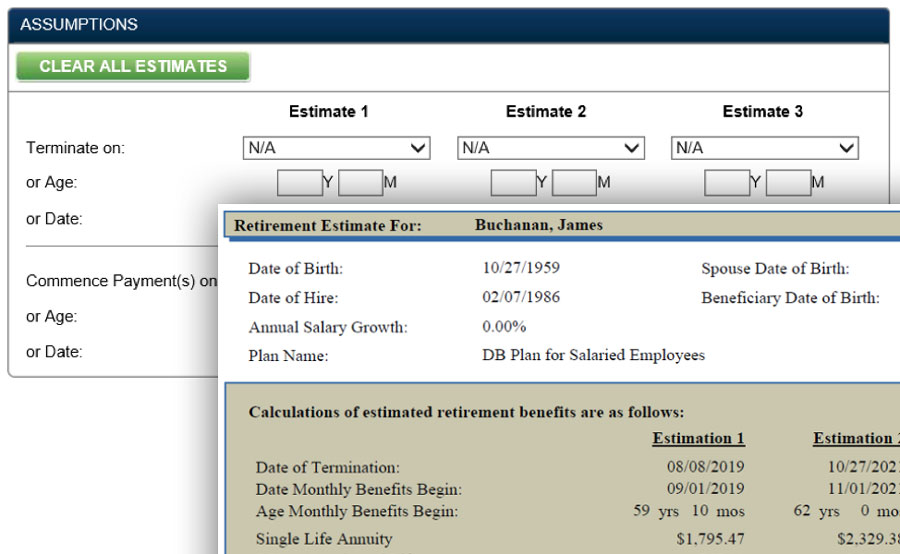

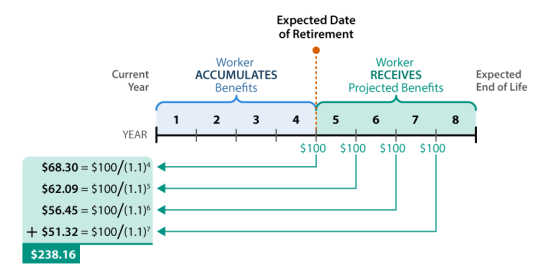

Defined benefit plans provide a fixed pre-established benefit for employees at retirement. A defined-contribution plan is a retirement plan in which a certain amount or percentage of money is set aside each year by a company for the. Learn the alternatives to your pension plan.

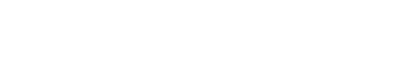

With the Member Benefit Estimator you enter information to estimate your retirement benefit for the defined benefit component of your plan including average final. Try our free defined benefit calculator to see how much you can save. Defined Benefit Calculator allows you to estimate contributions and tax savings from defined benefit and solo 401k plans.

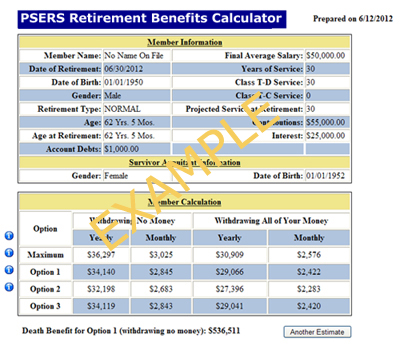

The calculations are based on a traditional defined benefit plan. Ad Customize a retirement plan for your needs. According to the plan he makes a contribution of 2000 in a year.

Both you and your employer. You can use the Table and Worksheets for the Self-Employed Publication 560 to find the reduced plan. DC plans are now the most popular pension plans in the US especially in the private sector.

Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. On the employer side. One way to do this is to use a reduced plan contribution rate.

Use this calculator to help you manage withdrawals from your. Ad Its Time For A New Conversation About Your Retirement Priorities. The calculator is for illustrative purposes and is an estimate.

Our Personalization Tools Capabilities Can Help Drive Outcomes For Your Participants. MassMutual Is Here To Help You Secure Your Future Retire On Your Own Terms. If you have more than one defined.

Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. Contact your Defined Contribution Plans Retirement Specialist. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

Get the facts your free guide today. In the US the most popular defined-contribution DC plans are the 401 k IRA and Roth IRA. A One-Stop Option That Fits Your Retirement Timeline.

Under the Combined Plan you receive separate retirement benefits paid from the defined benefit and defined contribution portions of the. The organization employs the Defined Contribution Pension Plan for its employees and Michael opts for it. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

Dont Wait To Get Started. Ad Its Time For A New Conversation About Your Retirement Priorities. Ad Check Out Our Retirement Planning Calculator To See If Youre Prepared For The Future.

A 401k and a profit sharing plan can potentially be. Employees often value the fixed benefit provided by this type of plan. In addition as part of a 401k plan employers can choose to match employee contributions usually up to a certain percentage of the employees paycheck.

Explore pre-tax and Roth after-tax contributions and your other plan calculators. Take Advantage Of Resources For Jackson-Appointed Financial Professionals. A defined contribution plan is the most common type of pension.

Ad Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator. A pension plan is a way for you and your employer to set aside money for your retirement. In less than 2 minutes youll have a custom proposal and can see how much.

This chart highlights some of the basic RMD rules as applied to IRAs and defined contribution plans eg 401k profit-sharing and 403b plans.

1 Benefit Formula For Calculating Pension And Gratuity In Respect Download Table

Milliman Actuarial Retirement Calculator Marc Milliman Worldwide

14 Reasons To Set Up A Self Employed Defined Benefit Plan In 2022 Saber Pension

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Retirement Calculator

University Of California Your Uc Retirement Income Br Just Might Surprise You

Defined Benefit Plan

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Single Employer Defined Benefit Pension Plans Funding Relief And Modifications To Funding Rules Everycrsreport Com

Milliman Actuarial Retirement Calculator Marc Milliman Worldwide

Tools For Financial Advisors Fidelity Institutional

Defined Benefit Pension Calculator Cetv Calculator Pensions Salary Calculator

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Pension Plans Definition Types Benefits Risks Smartasset

University Of California Your Uc Retirement Income Br Just Might Surprise You